Key Factors & Conclusion

FSA funds expire Dec. 31—spend them on eligible eyewear before they’re gone.

Take advantage of your FSA/HSA benefits for tax-free prescription glasses at ZEELOOL.

Only prescription eyewear is automatically eligible; non-prescription items may need a doctor’s note.

December 31st is approaching quickly. If you still have FSA funds sitting there, now is the time to act. HSA funds roll over year to year, but FSA balances? Usually gone if not spent. That’s why savvy shoppers are using their benefits for ZEELOOL eyewear to snag designer-looking frames with tax-free dollars before they vanish.

Buying eyewear is one of the few ways to empty a chunk of your FSA balance instantly. Think of it as a win-win: you protect your eye health, refresh your look, and make sure your tax-free dollars don't go to waste. And if you’ve been putting off replacing scratched lenses or outdated frames, this is the perfect opportunity to upgrade, as the FSA deadline of 2025 is near.

The Hard Numbers: 2025 vs. 2026 Limits (Cheat Sheet)

Here’s the quick breakdown for planning:

- 2025 FSA Contribution Limit: $3,300

- 2025 Carryover Limit: $660 only. Anything above that? Gone if not spent before December 31.

- 2026 FSA Limit: $3,400

- HSA Limits 2025: $4,300 individual / $8,550 family

Tip: Some employers offer a grace period (2.5 months, usually until March 15) instead of a carryover. Check your plan and HSA eyewear rules 2025. Not everyone gives you that extra buffer, and you don’t want to assume you’re safe.

The "Yes, No, Maybe" Eligibility Guide

Understanding what qualifies is half the battle. At ZEELOOL, we offer a wide range of high-quality vision products that are generally eligible for FSA/HSA reimbursement.

✅ Generally Eligible (Prescription Required):

- Prescription Eyeglasses: Including single vision, progressive lenses, and bifocals.

- Prescription Sunglasses: Protect your eyes from UV rays with your specific correction power.

- Specialty Lenses:

- Blue Light Blocking Lenses: For digital eye strain relief (with prescription).

- Anti-Fatigue Lenses: To help relax your eyes.

- Photochromic Lenses: Lenses that darken in sunlight (e.g., transitions).

- Reading Glasses: Over-the-counter readers are typically eligible.

⚠️ Check Your Plan (May require a Letter of Medical Necessity):

- Non-prescription Blue Light Glasses: Without a visual correction, some plans may require a doctor's note verifying they are for a specific medical condition.

- Non-prescription Sunglasses: These are generally not eligible unless medically necessary.

Crucial Step: Always check with your specific FSA/HSA administrator (the company managing your funds) to confirm eligibility guidelines for your plan before purchasing.

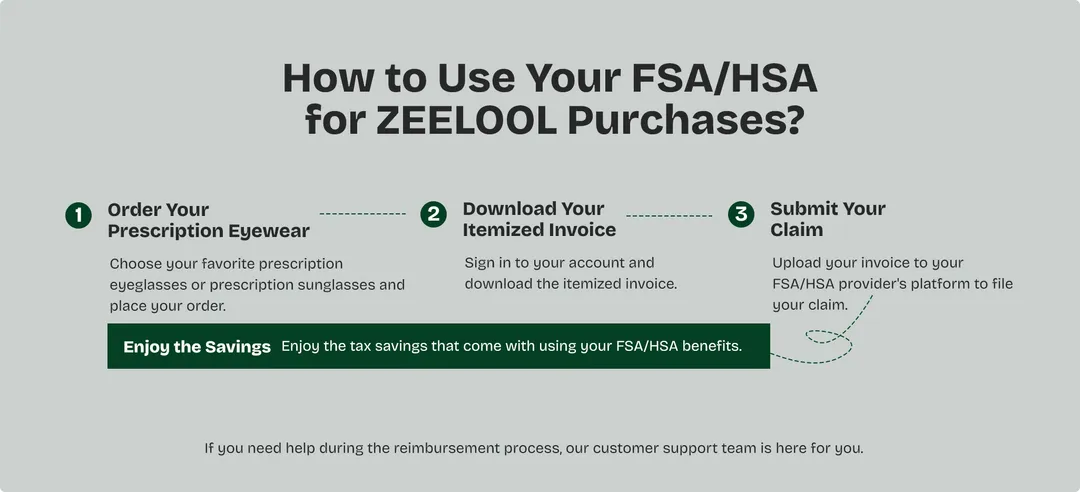

How to Use Your FSA/HSA for ZEELOOL Purchases

Since ZEELOOL uses a reimbursement model, the process is actually quite simple—think of it as "buy now, get paid back later." Here is the step-by-step breakdown to make sure you get your money back without a hitch:

Step 1: Order Your Prescription Eyewear

You should go and shop as usual. Select the prescription eyeglasses or prescription sunglasses you are so interested in and pay using your own credit/debit card. There are no special hoops to jump through here; you just have to make the purchase in order to get your glasses.

Step 2: Download Your Itemized Invoice

It is the most significant aspect that should be approved. Once the order is confirmed, log in to your account and select the My Orders section. You will be required to take down the official itemized invoice. Make sure it again contains your full name (or the recipient's name), the purchase date, and the name of the specific item. These details must be visible to your plan administrator so that he/she can understand that it is a legitimate medical expense.

Step 3: Submit Your Claim

Head over to your FSA or HSA provider’s website or mobile app. Most dashboards have a big "File a Claim" or "Reimburse Me" button. Simply upload the invoice you just saved. It usually takes less than five minutes to submit.

Step 4: Enjoy the Savings

That’s it! Once your claim gets the green light, the funds go straight back to you—typically via direct deposit or a check in the mail. You get the fresh look you wanted, and your pre-tax dollars foot the bill.

Note: Some people also combine FSA/HSA with promo codes or rewards points. Check ZEELOOL’s current offers to maximize savings. You can technically use your tax-free funds and still get a discount.

Stuck on a step? Don't worry. If you need help finding your invoice or understanding the details, our customer support team is ready to help you sort it out.

Strategic Spending: "What to Buy with Your Remaining Balance"

Scenario A: $50 left

A spare pair of reading glasses or a budget-friendly backup frame is perfect. Check the “Under $20” or “Readers” collection.

Scenario B: $150 left

A pair of blue light-blocking glasses makes sense, especially for office work. These offer both function and style. They can help reduce eye strain if you’re on screens all day, which is why many employers encourage using FSA dollars on them.

Scenario C: $300+ left

Time for high-value upgrades: progressive lenses or photochromic lenses (like Transitions). These justify using more of your FSA funds in one go. Remember, this is also the perfect time to pick stylish frames you might not normally splurge on—you’re using pre-tax dollars, after all.

Fashion Meets Function: 2025 Trends to Buy Now

Why not make your tax-free purchase fun? The IRS certainly doesn't require your glasses to be boring.

- Geometric Frames: Models like Bobbie or Verdejo. Standout personality pieces.

- Oversized/Retro: Think Tamecka or Murphy. Perfect for prescription sunglasses FSA.

- Crystal/Clear Frames: Joana series, sleek and modern.

Another option is to mix and match frames to fit your mood or the event. You can use your FSA or HSA money wisely to get one bold look for work and another for the weekend.

FAQs

Q: Can I use my FSA for my spouse or dependents?

A: Generally, yes. Most plans allow you to use your funds for your spouse and tax dependents.

Q: What if I return the glasses?

A: If you reimbursed yourself from your FSA and then returned the item for a refund to your personal card, you are responsible for returning those funds to your FSA account to avoid tax penalties. Please check with your administrator for the correct procedure.

Q: Does ZEELOOL accept insurance?

A: ZEELOOL is an out-of-network provider. We do not bill insurance directly. You will need to pay for your order and submit the receipt to your insurance provider for reimbursement based on your plan's out-of-network benefits.

Conclusion

December 31st isn’t far off. Don’t let your FSA funds disappear. Use them to buy prescription glasses with the FSA collection at ZEELOOL. Shop the FSA-eligible collection today and get the best of both worlds: style and tax savings.

Disclaimer: This is for informational purposes only; consult a tax professional.